Understanding Your 2024 Premium Rate Extended Statement – Ontario

In this article we will help you do a quick assessment of your experience rating performance by answering three very important questions:

- How is your performance?

- What factors determine your rates?

- How does your performance compare to the industry?

(You can find your 2024 Premium Extended Rate Statement on the WSIB Portal, under view your statements – released early November 2023)

1. How is your performance?

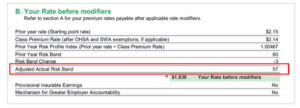

Under section B. Your Rate before modifiers, there are two sections to review.

(a) How is your performance trending?

- Next to Risk Band Change you will find a number that is either positive or negative. If this number is a negative number, your Risk Band it’s going down – meaning your performance is better than last year. If this number is a positive, your risk band is going up, performance is worse than last year.

Note: for every 1 Risk Band, that is approximately 5% increase or decrease in premiums.

(b) How do you compare to the industry?

- Next to Adjusted Actual Risk Band, this number is measured against 60, the industry average. If you are below 60, you are performing better than industry. Over 60, you are performing worse than industry. If your number is 60, you are on par with industry.

2. What factors determine your rates?

Under section C. Predictability, there are two sections to review.

(a) What influence does your own performance have on your rates?

- Next to Actuarial predictability you have been assigned a number. The greater the number, the greater the influence your own performance has on your rates. The scale is from 2.5% to 100% and is based on your insurable earnings (payroll) and your claim count (think “Rating Factor” in NEER, which was 40% to 100%).

Note: If your predictability is 50% or higher, you have more influence on the increase or decrease of your premiums. Meaning, on the positive side, you have ability to achieve more savings with strong claims performance and claims cost mitigation. In short, the greater the predictability number, the greater the risk and reward.

(b) What is the maximum cost you can incur per claim?

- At the bottom of the Predictability section, you will see your per claim limit. This is the maximum cost an individual claim can have. This number can change by the year and is directly related to your insurable earnings.

The larger the employer, the greater the per claim cost limit or risk.

3. How does your performance compare to the industry?

There is one section to review. Your performance is found under I. Adjusted Risk Profile.

- In section I. Adjusted Risk Profile – this is the comparison between your performance and the industry average performance. Your number is measured against 1, the industry average.

-

-

- If your number is 1, you are on par with the industry performance.

- If you are over 1, your costs are higher (worse performance) than industry.

- Under 1, your costs are lower (better performance) than industry.

-

This number is key in determining your projected risk band and the best measurement of how your company is performing vs. the industry.

Note: this is your aggregate performance within the 6-year experience rating window. For the 2024 statement years 2017-2022 are considered.

In Conclusion:

At Windley Ely we are here to help employers navigate the WCB’s across Canada. If you are reviewing any statements and your performance is not where you would like it to be, it’s not too late to turn things around or even retroactively address claims to reduce your costs now.

Our strategy for our clients is very simple: Review, Recoup, and Rest Assured.

Review – we take a detailed look at your historical claims to spot opportunities to mitigate costs. Our team of experts will challenge these claims and work to get you favorable decisions.

- In 2024, we can go back as far as the 2019 claim year in Ontario, to look for cost mitigation and recoup premiums.

Recoup – anytime there is a favourable decision, Windley Ely will ensure that your premiums, past and present, reflect the correct rate.

- One claim can equal hundreds of thousands of dollars in savings for some employers.

- With the 6-year window in Ontario, it’s extremely important that we mitigate all costs to avoid the impact to your premiums for years to come. For example, a contentious 2022 claim will directly impact your rate from 2024-2029.

Rest Assured – as a partner of Windley Ely, you can be certain that with every new claim, our team of experts will make sure that everything that can be done, will be done. We take the guess work out of WCB with full transparency and support to our clients. As a result, we remove the work from your desk, apply best practices to every claim, and protect your bottom line.

As a true example, in 2023 our Financial Analytics team spotted a WSIB error on our client’s rate calculation. Once the error was corrected by the WSIB, our client received just over $700,000.00 in adjustments on their past and future premiums. Our experts are trained to spot these errors and know how to get them corrected and refunded on your behalf.